Analysts Raise Their Domino's Pizza Price Targets - Short 1-Month DPZ Puts for a Lower Buy-In

/Dominos%20Pizza%20Inc%20storefront%20by-KathyDewar%20via%20iStock.jpg)

Analysts have been raising their price targets on Domino's Pizza (DPZ) stock. Moreover, selling short out-of-the-money (OTM) DPZ puts in near-term expiry periods is a good play to set a lower buy-in point.

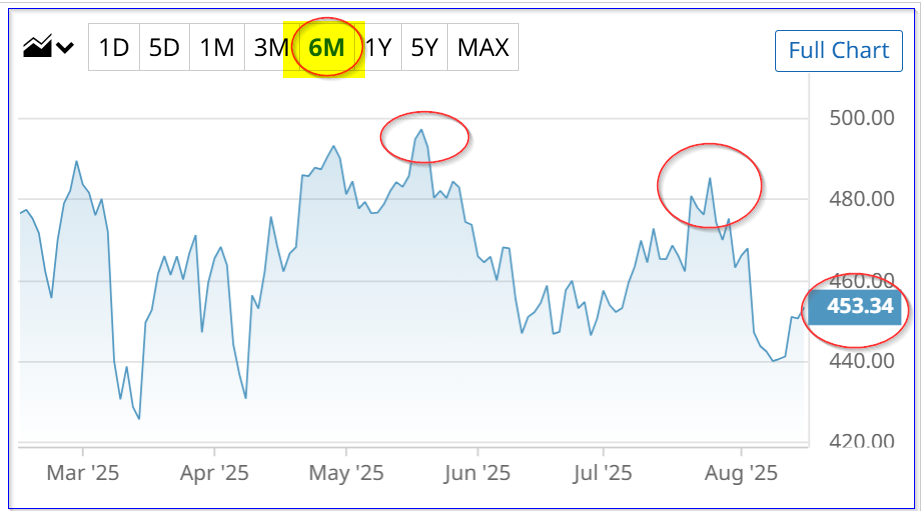

DPZ is at $449.08 today after reaching a near-term peak of $497.52 on May 19. I discussed Domino's recent results in a July 21 Barchart article ("Domino's Pizza Generates Strong Q2 Free Cash Flow - DPZ Stock Looks Cheap").

I wrote that DPZ stock could be worth $566.45, or 21.9% higher than the price at the time of $464.76 per share. That was based on its strong free cash flow (FCF) and FCF margins.

That means it is now worth over +23.9% more than today's price.

Analysts' Price Targets

Moreover, at the time, analysts had price targets ranging between $486 and $514 per share. Since then, however, many have raised their price targets.

For example, Yahoo! Finance reports that 32 analysts have an average price target of $508.93 today. That is up from $505.35 three weeks ago.

Similarly, Barchart now shows an average of $511.48, up from $509.55. However, other surveys show lower price targets, including Stock Analysis at $486.75 ($486.83 three weeks ago), and AnaChart at $500.77 (vs. $514.99 before).

The average of these four surveys is $501.98 (vs. $503.98 before), although the median is now $504.85. Moreover, without the last large drop in the AnaChart figure, the average would be higher.

The bottom line is that analysts still think DPZ stock looks cheap here.

One way to play this is to set a lower buy-in target point by shorting out-of-the-money (OTM) puts in nearby expiry periods.

Shorting OTM DPZ Puts

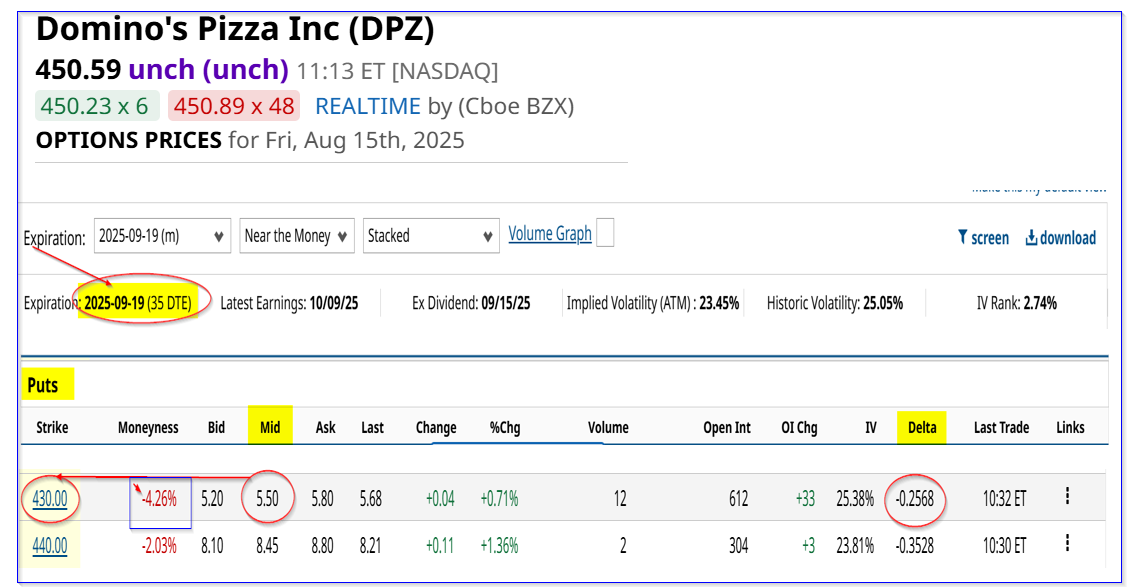

I discussed this in my Barchart article on July 21, where I recommended shorting the $140 strike price put option expiring today, Aug. 15.

At the time, DPZ stock was at $463.07, so the $140 strike price was over 5% below the trading price. But the premium received was $3.75, or a short-put yield of 0.852% (i.e., $3.75/$440) for three weeks.

Today, that strike price premium is just 18 cents at the midpoint, and it's likely to close out-of-the-money (i.e., expire worthless today). That makes this a successful short play.

So, it makes sense to roll this trade over by entering an order to “Buy to Close” and then do a new “Sell to Open” trade in a further out expiry period.

For example, the Sept. 19 expiry period shows that the $430 put option strike price has a midpoint premium of $5.50. That strike price is over 4% below today's trading price, but this short put play has a higher 1-month yield (35 days to expiry or DTE).

The yield for a short-seller of these puts is $5.50/$430, or 1.28% for the next month.

In addition, even after covering the Aug. trade (i.e., spending 18 cents per contract to buy back the Aug. 15 put), the net yield is 1.237% (i.e., ($5.50-$0.18)/$430, or $5.32/$430.0).

That means that over the 2 months, an investor would have collected a net $907 for an average investment of $43,500. That means the two-month yield is 2.085% or an average of 1.0425% per month.

The point is that this is an easy way to set a potentially lower buy-in point (i.e., in case DPZ falls to $430.00 in the next 35 days and get paid while waiting.

Even if that happens, the investor's breakeven point would be $5.37 plus $3.75 collected last month, or $9.07 lower than $430, i.e., $420.93. That is 6.58% below today's trading price, so it provides good downside protection.

The bottom line is that DPZ stock still looks undervalued, and one way to play it is to short OTM puts in one-month away expiry periods.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.