Are Crude Oil Prices Going Much Lower?

NYMEX WTI crude oil futures have traded in a range of $55.12 to $79.39 per barrel in 2025. At just above the $62 level in mid-August, the energy commodity is sitting below the midpoint of the 2025 trading range. In my Q2 Barchart report on the energy sector, I concluded with the following:

Meanwhile, OPEC+ has increased petroleum output, and the U.S. energy policy now favors a “drill-baby-drill” and “frack-baby-frack” approach to oil and gas. Increasing U.S. and OPEC+ output could put downward pressure on prices. The bottom line is that petroleum and product prices could be highly volatile over the second half of 2025.

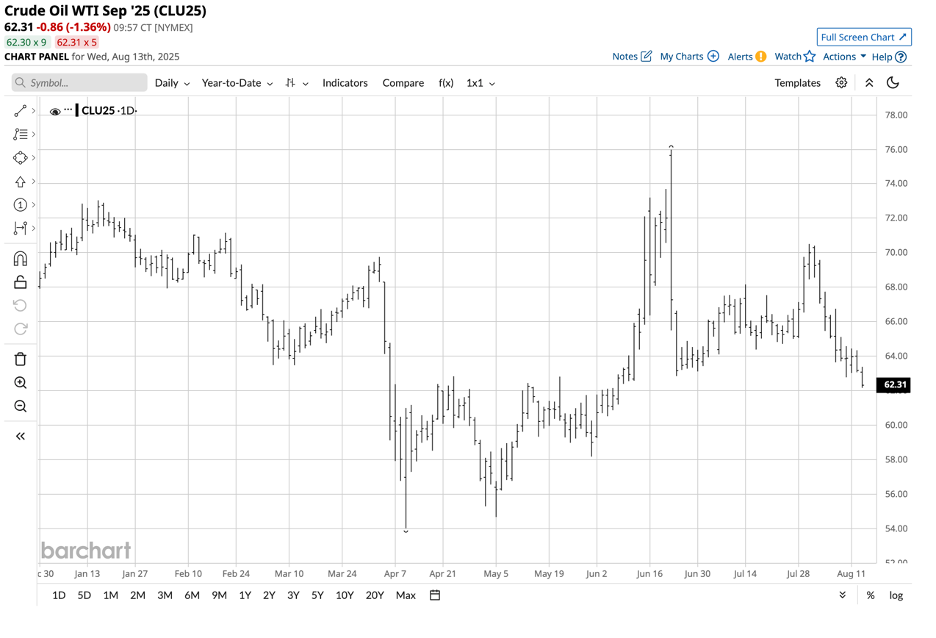

Nearby NYMEX crude oil futures fell 8.91% in Q2, and were 9.22% lower over the first six months of 2025, settling at $65.11 per barrel on June 30, 2025. The NYMEX futures were lower in mid-August as the end of the 2025 peak driving season approaches, and the trend has turned lower since the late July high.

The short-term trend is lower

Bearish sentiment has crept into the NYMEX crude oil market, as the price has been trending lower since the most recent July 30, lower high of $70.51 per barrel on the September contract.

The daily chart highlights the pattern of lower highs and lower lows since the end of July, with crude oil posting mostly daily declines from July 31 through August 13.

OPEC+ and U.S. energy policy point lower

Crude oil fundamentals reflect increased production. While U.S. daily domestic crude oil production was at 13.327 million barrels per day as of the week ending on August 8, 2025, U.S. energy policy under the Trump administration favors a “drill-baby-drill” and “frack-baby-frack” approach to oil and gas production. In a reversal from the previous Biden administration, President Trump supports traditional energy production and consumption to achieve energy independence and self-sufficiency. Moreover, the current administration favors increasing U.S. traditional energy exports, creating revenues. Increased U.S. production, which weighs on oil prices, will help lower inflationary pressures, increasing the odds of falling U.S. interest rates, a key goal of the Trump administration.

Meanwhile, OPEC+ has increased production over the past months, adding further pressure to the oil price. While crude oil’s price remains higher than the 2025 low, the short-term trend has turned lower as the petroleum market shifts toward the end of the gasoline demand season, which typically concludes after summer.

Critical levels to watch in the NYMEX futures

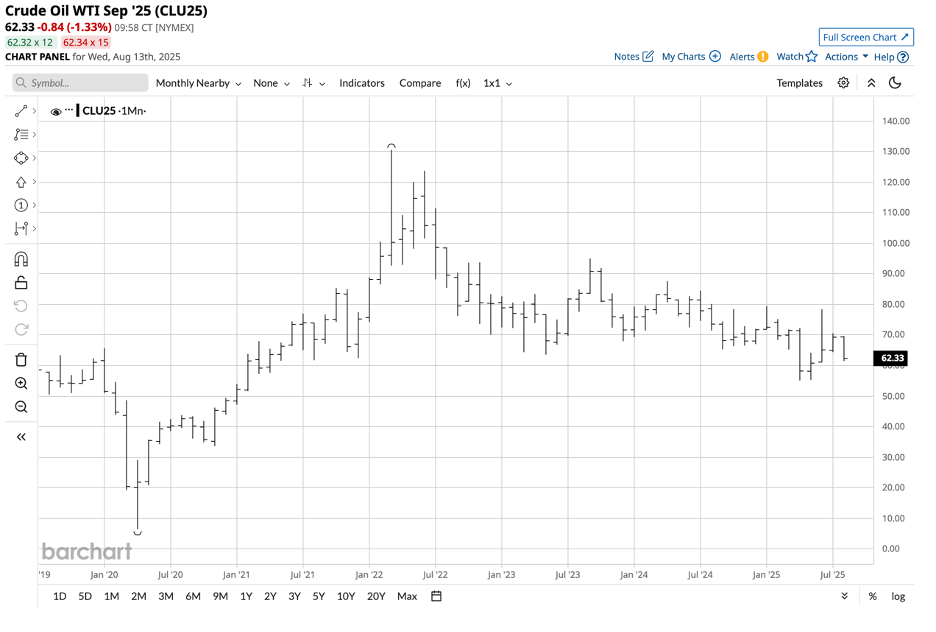

The monthly chart shows that nearby NYMEX crude oil futures have traded on a $55.12 to $79.39 per barrel range in 2025. At around $62.25 per barrel on August 13, the energy commodity was around $5 below the midpoint of this year’s trading range.

The monthly chart highlights that the current downside technical support level is at the April 2025 low of $55.12 per barrel. Technical resistance levels are at the June 2025 high of $78.40 and the January 2025 peak of $79.39 per barrel. A break below the $60 level will likely cause crude oil prices to challenge the critical technical resistance at just above $55 per barrel, the lowest price since February 2021.

The Middle East and Russia remain potential issues

The Middle East is a critical factor in determining the path of least resistance for crude oil prices. Israel and the U.S. remain at odds with Iran despite the ceasefire of hostilities after the bombing of Iran’s nuclear infrastructure. However, the theocracy remains firmly in control and has not backed off from inflammatory statements towards Israel, the United States, and other Western countries. Iran’s proxies in the region continue to pose a threat to peace.

The Straits of Hormuz remain a major chokepoint for worldwide petroleum exports, so any future conflicts could ignite an explosive crude oil rally due to supply concerns.

Meanwhile, Presidents Trump and Putin will meet in Alaska on Friday, August 15 to discuss the ongoing war in Ukraine. Any peace deal could include Russian cooperation on energy policies that would lead to crude oil prices to declining toward the $50 per barrel level or lower, given President Trump’s desire to curb inflation and lower interest rates.

UCO and SCO turbocharge volatility in NYMEX crude oil but require careful risk-reward attention

Crude oil is one of the most politically charged commodities, and in a highly volatile world, the price of petroleum is likely to experience ongoing elevated volatility. Since the 2020 global pandemic, nearby NYMEX prices have traded as low as in negative territory to as high as $130.50 per barrel. While I do not expect any challenge of those lows or highs in 2025, the potential for sudden rallies above this year’s high or declines to new lows remains high in the current environment.

Trading crude oil could be a highly profitable strategy. The most direct route for a risk position in the energy commodity is through the WTI futures or futures options trading on the CME’s NYMEX division, or Brent futures or futures options traded on the Intercontinental Exchange.

The USO and BNO ETFs are unleveraged products that track the performance of WTI and Brent futures, respectively. UCO and SCO are twice-leveraged ETFs that track the NYMEX WTI crude oil prices.

At $21.83 per share, UCO, the bullish ETF, has over $386.4 million in assets under management. UCO trades an average of nearly 2.7 million shares daily and charges a 0.95% management fee. The most recent significant rally in September NYMEX crude oil futures took the price 39% higher, from the May 5 low of $54.66 to the June 23 high of $75.98 per barrel.

Over the same period, UCO rallied 54.88% from $18.35 to $28.42 per share, delivering a leveraged upside percentage return.

At $18.27 per share, the bearish SCO ETF had over $158.4 million in assets under management. SCO trades a daily average of over 2.955 million shares and charges the same 0.95% management fee. The most recent significant decline in WTI September futures took the price 18.2% lower from a high of $75.98 on June 23 to a low of $62.16 on August 13.

Over around the same period, the SCO ETF rose 25.5% from $14.57 to $18.29 per share, delivering a leveraged percentage return when crude oil prices moved to the downside.

UCO and SCO are leveraged trading tools that are only appropriate for short-term risk positions on the long or short side of the oil market. However, they provide market participants the opportunity to position in crude oil in standard brokerage accounts. The leveraged ETFs have drawbacks, including:

- Leverage comes at a cost. If NYMEX crude oil prices move contrary to expectations, the leverage results in a greater percentage decline than the crude oil futures market.

- If crude oil prices stabilize and remain within a trading range, UCO and SCO will experience time decay, which erodes their values and causes losses.

- While the international crude oil markets, including NYMEX futures, trade around the clock, UCO and SCO are only available during the U.S. stock market’s trading hours. Therefore, the leveraged ETFs can miss highs or lows when the U.S. stock market is closed.

UCO and SCO’s leverage requires careful attention to risk-reward dynamics. Time decay means that price and time stops are required for risk positions, which are only appropriate for short-term horizons.

Crude oil is leaning lower in August 2025, with the odds of a challenge to the 2025 lows rising. However, the volatile Middle East could turn the bear into a bull in the blink of an eye. Trading in crude oil rather than investing, could be optimal over the coming weeks and months. The August 15 meeting between Presidents Trump and Putin could cause significant price volatility in the crude oil market.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.