What Are Wall Street Analysts' Target Price for Sherwin-Williams Stock?

The Sherwin-Williams Company (SHW), valued at a market cap of $92 billion, is an Ohio-based paint and coatings leader founded in 1866. It develops, manufactures, distributes, and sells a wide range of paints, coatings, and related products to professional, industrial, commercial, and retail customers through three segments: the Paint Stores Group, the Consumer Brands Group, and the Performance Coatings Group.

Shares of the company have lagged behind the broader market, surging 5.7% over the past 52 weeks and 8.5% on a YTD basis. In comparison, the S&P 500 Index ($SPX) has returned 19% over the past year and 10% in 2025.

Narrowing the focus, SHW has outperformed the Materials Select Sector SPDR Fund’s (XLB) 2.2% rise over the past 52 weeks and its 8.1% rally this year.

On Jul. 22, Sherwin-Williams shares dipped marginally after releasing its second-quarter earnings. It posted sales growth of 0.7% to $6.31 billion, but profits fell sharply, with adjusted EPS down 8.6% to $3.38, missing estimates. The quarter also saw $59 million in restructuring charges and $40 million in building-related costs, prompting the company to lower its full-year adjusted EPS guidance to $11.20–$11.50 and forecast flat to low-single-digit sales change.

For the current year ending in December, analysts predict SHW’s EPS to fall marginally year over year to $11.28. Moreover, the company has surpassed analysts’ consensus estimates in two of the past four quarters, while missing on two occasions.

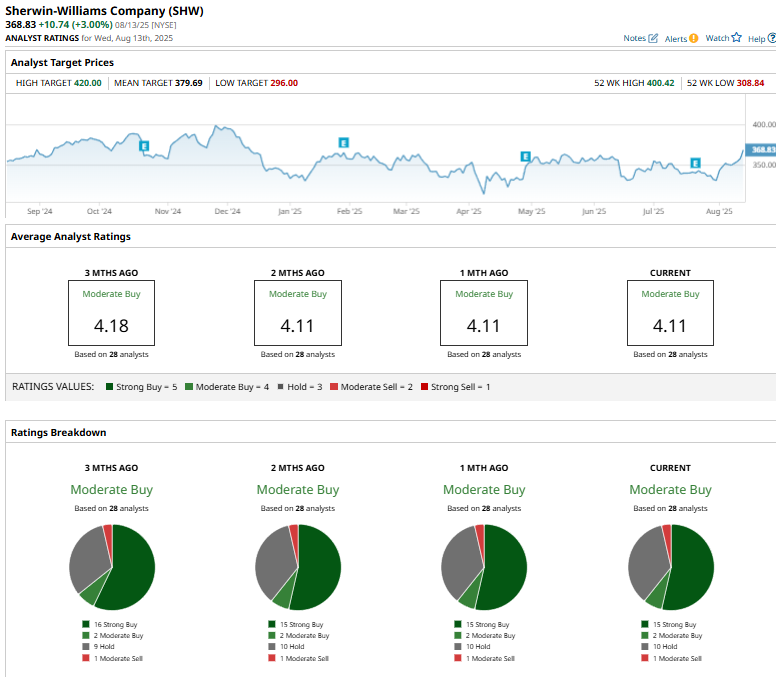

Among the 28 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, two “Moderate Buys,” ten “Holds,” and one “Moderate Sell.”

The configuration is slightly less bullish than three months ago, when 14 analysts gave the stock a “Strong Buy.”

On Jul. 24, UBS Group AG (UBS) analyst Joshua Spector maintained a “Buy” rating on Sherwin-Williams but reduced the price target from $410 to $395.

SHW’s mean price target of $379.69 indicates a premium of 2.9% from the current market prices. Its Street-high target of $420 suggests a robust 13.9% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.