Is Palantir the Safest AI Stock to Buy in a Volatile Market?

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Palantir Technologies (PLTR) has been riding the artificial intelligence (AI) wave for around two decades. However, unlike the majority of players in the field, it went unnoticed until its large government contract wins and rapid commercial expansion brought it to the spotlight.

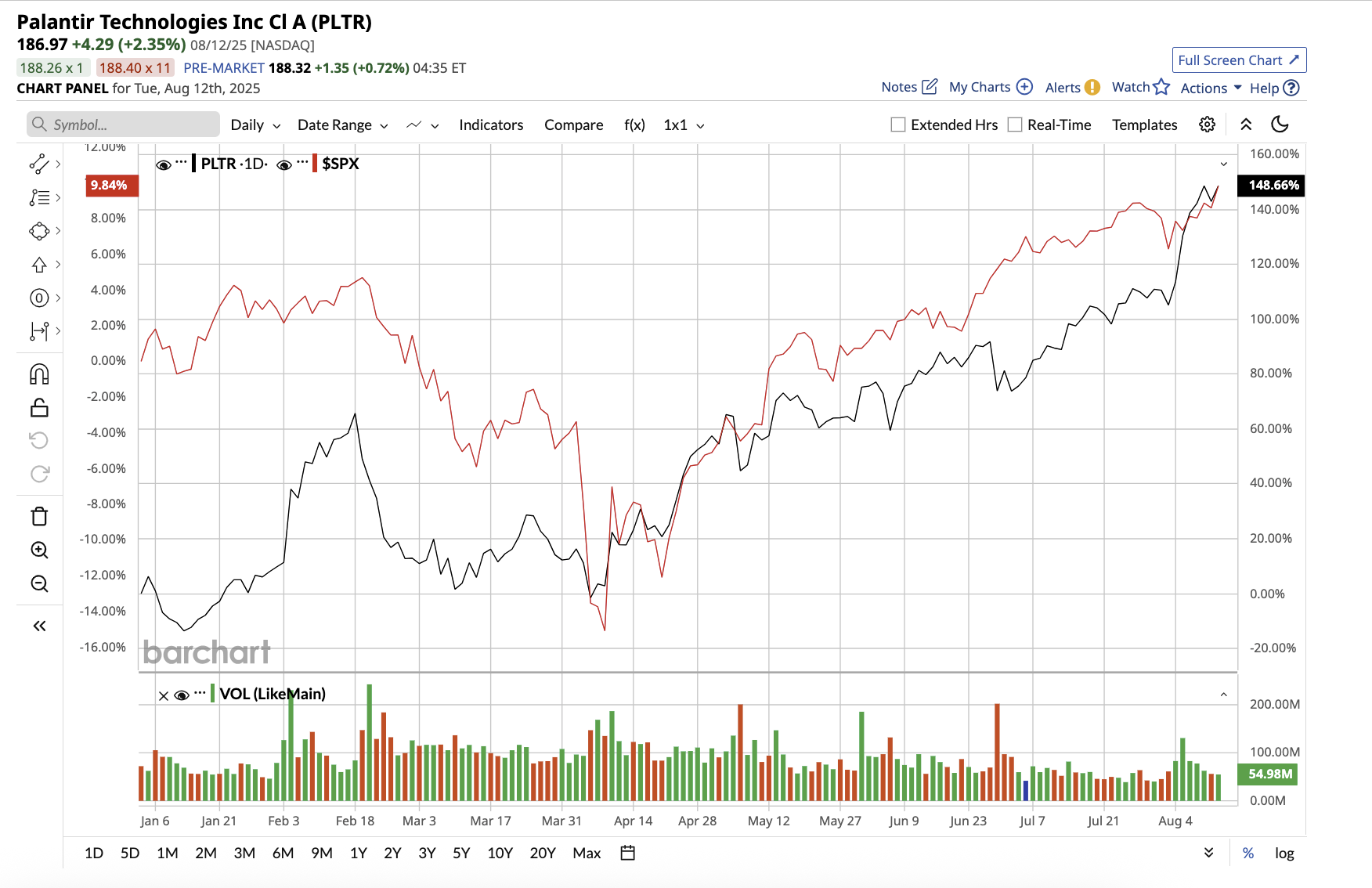

While some admire the company’s exponential growth, others criticize it for its unconventional methods. Nonetheless, Palantir has become unstoppable. The stock is up 145% year to date, outperforming the market as a whole, which is up 9.7%. Let’s see if the stock is a buy now.

Valued at $441 billion, Palantir develops advanced data analytics software that assists governments, businesses, and other organizations in collecting, integrating, and analyzing large, complex datasets to make better decisions, detect patterns, and solve problems. Its Gotham, Foundry, and AIP platforms are widely used in industries such as defense, intelligence, healthcare, finance, and supply chains.

Palantir reported a stellar second quarter. For the first time, the company exceeded $1 billion in quarterly revenue, representing a 48% year-over-year increase. Furthermore, its Rule of 40 score reached 94, indicating a healthy balance of rapid growth and strong profitability, which is a rare combination in the AI sector. The U.S. business remains the growth engine, contributing 73% to total revenue. U.S. commercial revenue surged 93% year-over-year, while U.S. government revenue rose 53% year-over-year. The rate of growth in commercial adoption, which was previously a weaker area for Palantir, indicates a strategic shift that could maintain momentum in the coming years. The company’s remaining performance obligations (RPO) reached $2.4 billion, up 77% year on year. Adjusted EPS was $0.16 per share.

Big Deals, Bigger Pipeline

The second quarter marked a quarter of massive contract wins, with 157 deals worth more than $1 million, 66 deals worth more than $5 million, and 42 deals worth more than $10 million.

Total contract value (TCV) reached $2.3 billion, with annual contract value (ACV) at $684 million, both record highs. Notably, Palantir’s top 20 customers now have an average trailing 12-month revenue of $75 million, a 30% increase year over year, indicating that once Palantir acquires a client, its footprint within that organization tends to grow significantly.

Palantir ended the second quarter with $6 billion in cash, cash equivalents, and short-term U.S. Treasury securities, providing a solid foundation for future product investment.

Government: A Deep and Sticky Relationship

While the commercial segment is expanding faster, Palantir’s government business remains a cornerstone and one of the primary reasons why Palantir may be the safest AI play. The U.S. Space Force has awarded a $218 million delivery order for multi-domain warfighting support. The ceiling for its Maven Smart System contract was raised by $795 million to meet increasing AI demand from combatant commands. Most notably, Palantir signed a 10-year, $10 billion enterprise agreement with the U.S. Army, combining 75 separate contracts into one.

These long-term, mission-critical government contracts generate recurring revenue, which provides stability, especially in uncertain market conditions. Palantir’s AI platforms are deeply embedded in critical enterprise and defense systems, resulting in high switching costs for clients. Furthermore, unlike many other smaller AI plays, Palantir generates consistent cash flow and margins while balancing growth and profitability.

For the full year 2025, the company anticipates 45% year-over-year revenue growth to $4.14 billion to $4.15 billion, with 85% growth in U.S. commercial revenue. The company also anticipates GAAP profitability in all quarters of 2025 and adjusted free cash flow of $1.8 billion to $2 billion. Analysts expect Palantir’s earnings to rise by 58.2% in 2025 and 30.8% in 2026. Palantir's stock is expensive, trading at 220 times 2026 estimated earnings.

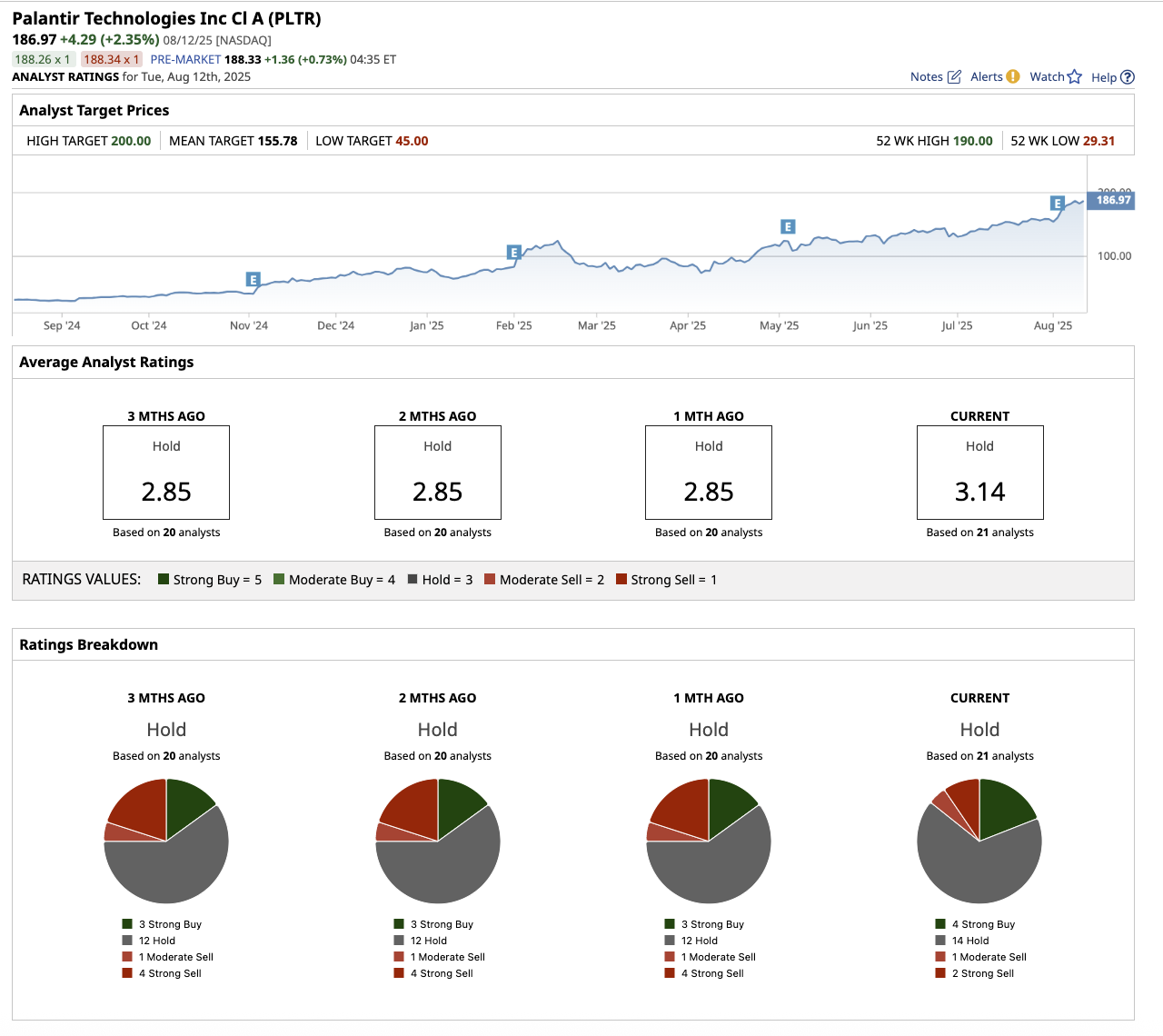

Is PLTR Stock a Buy, Hold, or Sell on Wall Street?

Overall, on Wall Street, Palantir stock is a “Hold.” Among the 21 analysts that cover the stock, four rate it a “Strong Buy,” 14 say it is a “Hold,” one rates it a “Moderate Sell,” and two say it is a “Strong Sell.” Despite the muted outlook, Palantir stock has skyrocketed this year, surpassing its average target price of $155.78. Its Street-high estimate of $200 implies the stock has upside potential of 7% from current levels.

The Bottom Line

While Palantir’s positioning is strong, critics remain skeptical, citing the company’s heavy reliance on U.S. government contracts, which means that political or budgetary changes could impact revenue. Palantir has been working on this by rapidly expanding its commercial business to create a more balanced revenue stream.

Palantir’s combination of high growth, profitability, established customer relationships, and proven technology may make it one of the safest AI investments available. However, given the premium valuation, risk-averse investors may want to wait for a more favorable entry point.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.