CF Industries Stock Outlook: Is Wall Street Bullish or Bearish?

With a market cap of $13.4 billion, CF Industries Holdings, Inc. (CF) is a leading global manufacturer and distributor of hydrogen and nitrogen products. Serving agriculture, energy, and industrial markets, the company produces ammonia, granular urea, UAN, and other nitrogen-based solutions from major facilities in the U.S., Canada, and abroad.

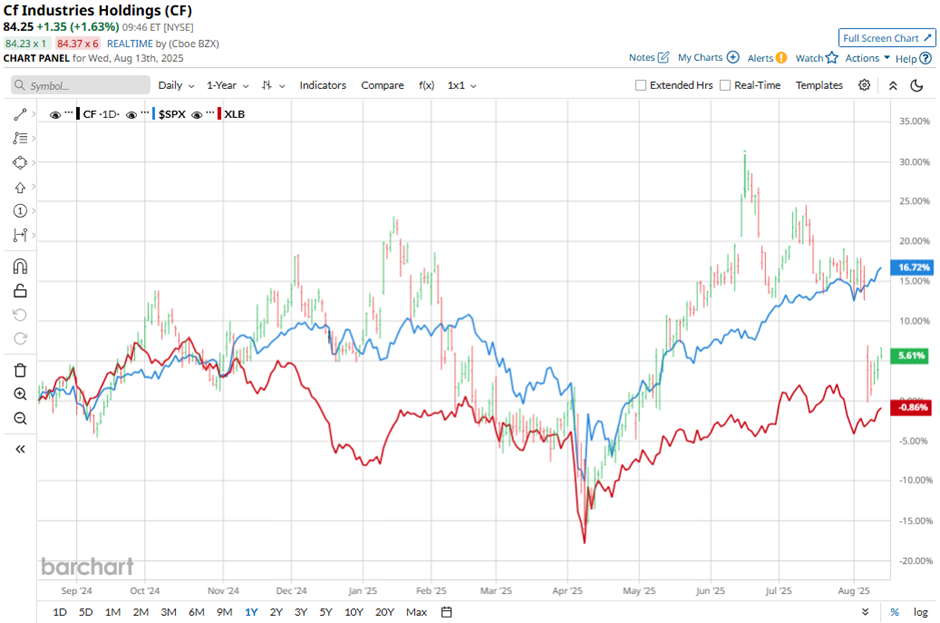

Shares of CF Industries have underperformed the broader market over the past 52 weeks. CF stock has risen 4.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 20.6%. Moreover, shares of CF Industries have decreased marginally on a YTD basis, compared to SPX's 9.6% return.

Looking closer, the fertilizer maker stock has outpaced the Materials Select Sector SPDR Fund's (XLB) marginal rise over the past 52 weeks.

Despite reporting better-than-expected Q2 2025 net income of $2.37 and revenue of $1.9 billion on Aug. 6, CF Industries’ shares fell 7.8% the next day. Its gross margin fell to 39.9% due to higher natural gas costs of $3.36/MMBtu. Investors were also cautious about the company’s rising capital expenditures, now projected at $800 million - 900 million for 2025, including $300–$400 million for the Blue Point joint venture, and the impact of consolidating JV expenses. Additionally, the ammonia segment’s gross margin per ton dropped to $125, and the UAN segment’s adjusted gross margin percentage slipped to 51.7%, raising concerns about margin compression despite higher sales.

For the current fiscal year, ending in December 2025, analysts expect CF's EPS to grow 8.2% year-over-year to $7.29. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

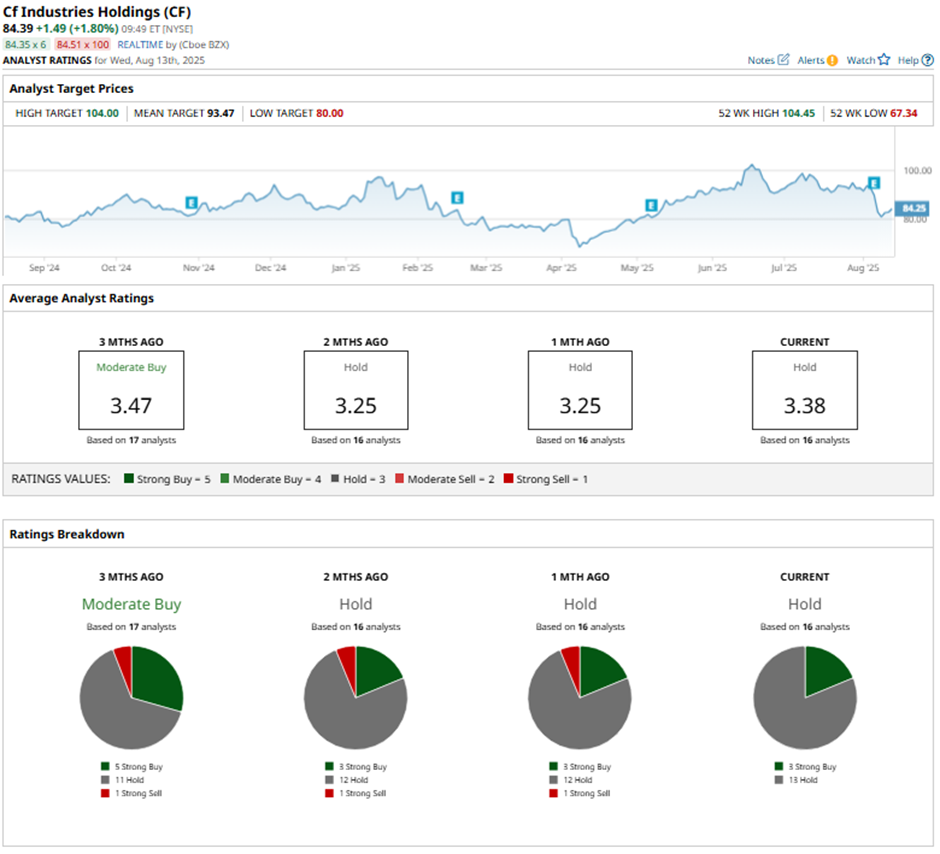

Among the 16 analysts covering the stock, the consensus rating is a “Hold.” That’s based on three “Strong Buy” ratings and 13 “Holds.”

This configuration is less bullish than three months ago, with five “Strong Buy” ratings on the stock.

On Aug. 13, Barclays upgraded CF Industries to “Overweight” from “Equal Weight”, raising its price target to $100, citing benefits from low-carbon ammonia initiatives and ongoing share repurchases.

As of writing, the stock is trading below the mean price target of $93.47. The Street-high price target of $104 implies a modest potential upside of 23.2% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.