Is Wall Street Bullish or Bearish on NetApp Stock?

/Netapp%20Inc%20sign%20in%20San%20Jose%2C%20Ca-by%20Tada%20Images%20via%20Shutterstock.jpg)

San Jose, California-based NetApp, Inc. (NTAP) provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures. Valued at $21.2 billion by market cap, the company's storage solutions include specialized hardware, software, and services that provide storage management for open network environments.

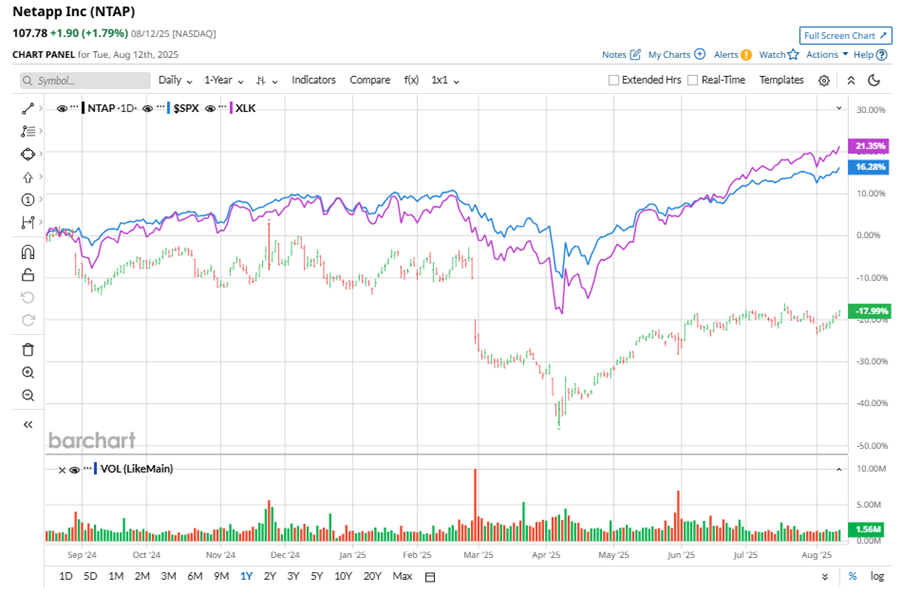

Shares of NetApp have underperformed the broader market over the past year. NTAP has declined 12.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 20.6%. In 2025, NTAP stock is down 7.2%, compared to the SPX’s 9.6% rise on a YTD basis.

Narrowing the focus, NTAP’s underperformance is also apparent compared to the Technology Select Sector SPDR Fund (XLK). The exchange-traded fund has gained about 29.4% over the past year. Moreover, the ETF’s 15.4% returns on a YTD basis outshine the stock’s single-digit losses over the same time frame.

On May 29, NTAP shares closed down marginally after reporting its Q4 results. Its adjusted EPS of $1.93 surpassed Wall Street expectations of $1.90. The company’s revenue was $1.7 billion, matching Wall Street forecasts. NTAP expects full-year adjusted EPS in the range of $7.60 to $7.90, and expects revenue to be between $6.6 billion and $6.9 billion.

For fiscal 2026, ending in April 2026, analysts expect NTAP’s EPS to grow 7.4% to $6.22 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

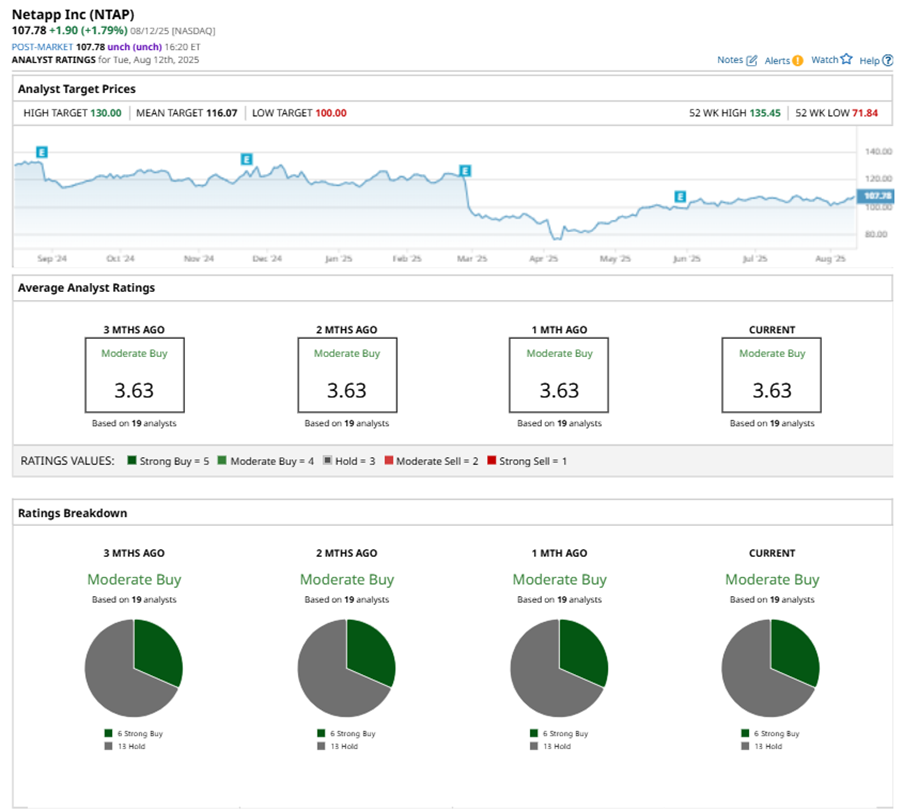

Among the 19 analysts covering NTAP stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, and 13 “Holds.”

The configuration has been consistent over the past three months.

On Aug. 11, Citigroup Inc. (C) kept a “Neutral” rating on NTAP and raised the price target to $115, implying a potential upside of 6.7% from current levels.

The mean price target of $116.07 represents a 7.7% premium to NTAP’s current price levels. The Street-high price target of $130 suggests an upside potential of 20.6%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.