Are Wall Street Analysts Bullish on Humana Stock?

/Humana%20Inc_%20app%20on%20phone%20-by%20rafapress%20via%20Shutterstock.jpg)

Humana Inc. (HUM) is a leading U.S. health insurance company headquartered in Louisville, Kentucky, with a market cap of about $33.1 billion. Operating in the healthcare sector, specifically within the managed healthcare industry, Humana offers a broad portfolio of medical and specialty insurance products, with a strong focus on Medicare Advantage plans.

The company serves millions of members nationwide through its Insurance and CenterWell segments, which encompass health services, pharmacy solutions, and primary care.

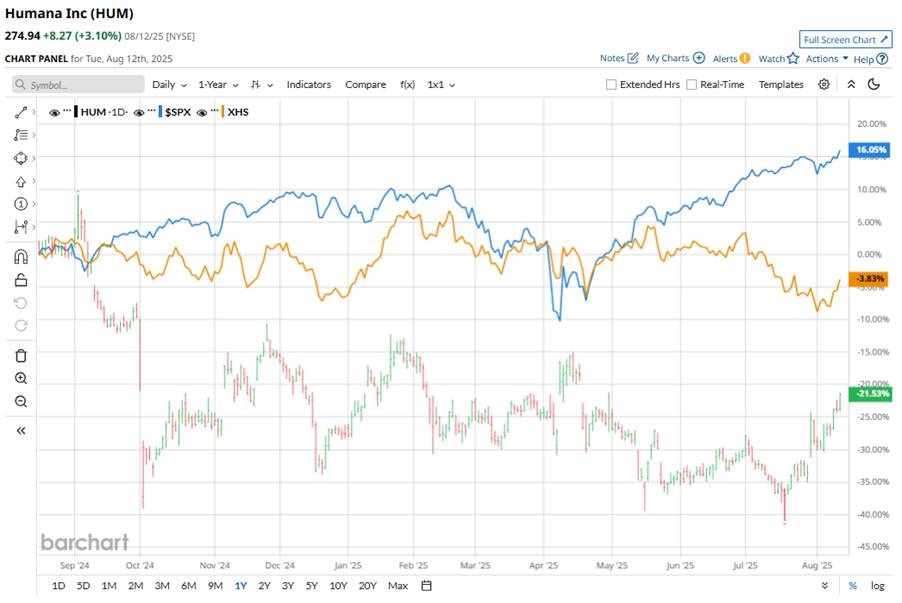

The medicare giant’s 2025 journey has been a steady cruise so far, with its shares up about 8.4% year-to-date (YTD) - enough to show strength - though still a step behind the S&P 500 Index’s ($SPX) 9.6% gain. However, HUM stock shines in its own lane, easily outperforming the SPDR S&P Health Care Services ETF (XHS), which gained just 2.9% over the same period.

But widen the lens to the past 52 weeks, and the picture shifts. HUM is down by 21.1%, not just lagging behind the SPX’s 20.6% gains, but also XHS, which dipped by 1.6%.

The stock has recently regained momentum following its mixed second-quarter report released on July 30, with adjusted EPS of $6.27, compared to the prior-year quarter value of $6.96, while revenue climbed to $32.4 billion.

Investors rejoiced as the company raised its full-year EPS outlook to around $17 and forecasted revenue of at least $128 billion, driven by improved Medicare Advantage retention, stabilized medical costs, and continued growth in its CenterWell Pharmacy segment.

While the broader healthcare sector has been weighed down by rising medical costs, regulatory pressures, and a pullback in medicare advantage expansion, Humana’s operational improvements and upbeat guidance have boosted investor confidence, setting it apart from sector peers.

For the current fiscal year, ending in December 2025, analysts expect HUM to report EPS growth of 4.8% YoY to $16.99, on a diluted basis. The company has a decent track record of beating Wall Street’s estimates, topping consensus EPS estimates in three of the trailing four quarters.

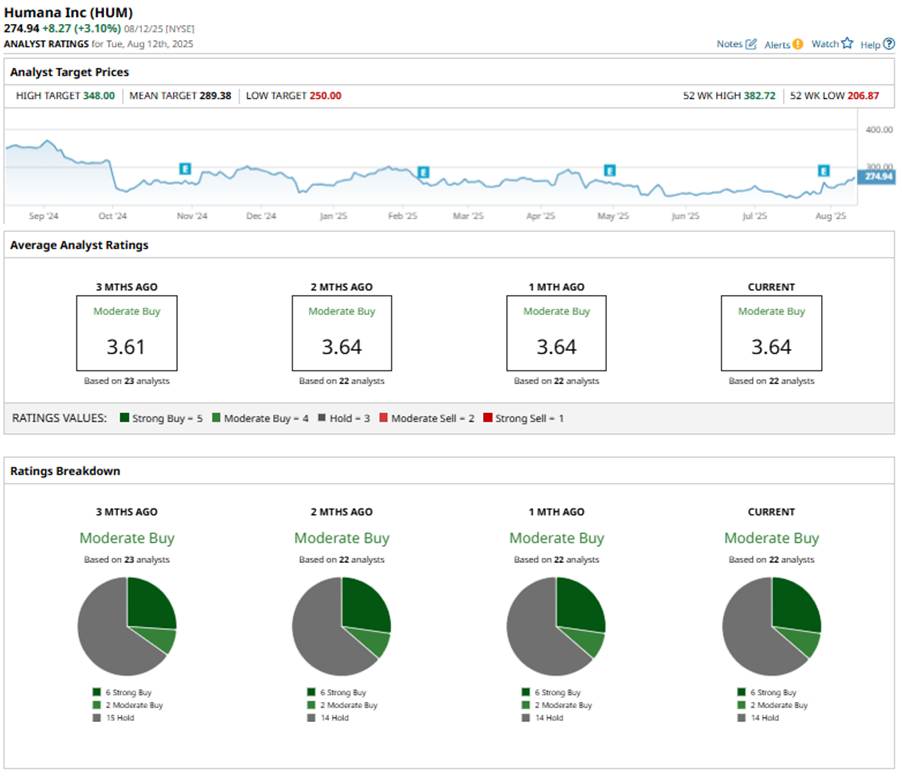

Among the 22 analysts covering HUM stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buys,” two “Moderate Buys,” and 14 “Hold” ratings.

The current configuration has remained largely consistent over the past few months.

Earlier this month, Raymond James doubled down on its bullish stance for HUM stock, keeping the “Outperform” rating and $340 target after Q2 2025 results, and an upbeat outlook from management.

The mean price target of $289.38 indicates a premium of 5.3% to HUM’s current price, while the Street-high price target of $348 suggests an upside potential of 26.6%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.