Datadog Stock: Analyst Estimates & Ratings

With an impressive market cap of $44.5 billion, Datadog, Inc. (DDOG) is a leading cloud-based monitoring and analytics platform. Headquartered in New York City, it provides real-time visibility into an organization’s entire technology stack by integrating and analyzing data from servers, databases, applications, and cloud services.

Shares of Datadog have underperformed the broader market considerably over the past year. DDOG has surged 15% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 20.6%. In 2025, Datadog stock dipped 9.8%, while the SPX is up 9.6% on a YTD basis.

Narrowing the focus, DDOG has outperformed the SPDR S&P Software & Services ETF (XSW). The exchange-traded fund has gained about 23.5% over the past year and has declined 4.7% in 2025.

On Aug. 7, Datadog’s shares climbed over 5% after the company reported its second-quarter earnings. It posted 28% year-over-year revenue growth, with total revenue reaching $827 million. Its non-GAAP operating income stood at $164 million with a 20% margin, and non-GAAP diluted EPS came in at $0.46.

Datadog ended the quarter with approximately 3,850 customers generating $100,000 or more in ARR, a 14% increase from a year ago. The company also unveiled over 125 new innovations at its DASH 2025 conference, including enhancements in AI observability and security.

For the current fiscal year, ending in December, Street expects DDOG’s EPS to fall 46.8% year over year to $0.25. However, the company’s earnings surprise history is solid. It surpassed or met the consensus estimate in each of the last four quarters.

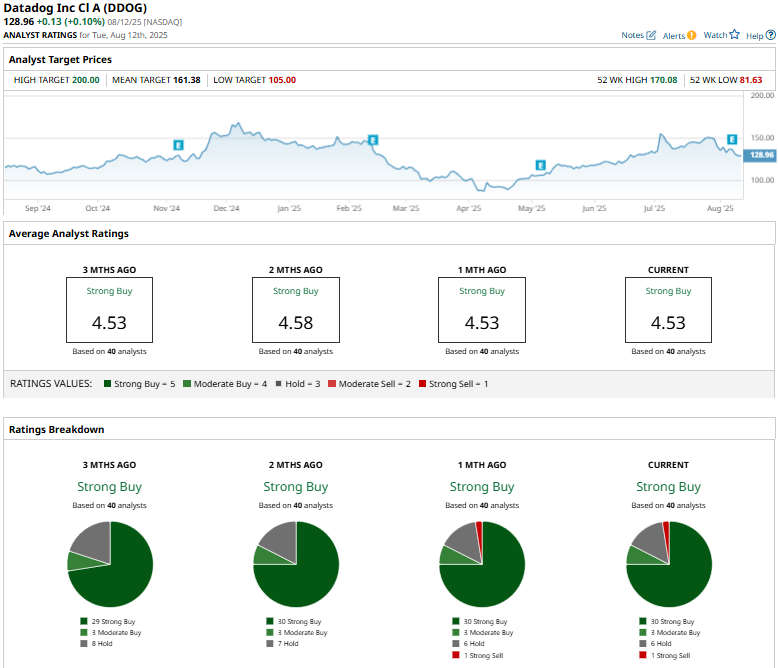

Among the 40 analysts covering DDOG stock, the consensus rating is a “Strong Buy.” That’s based on 30 “Strong Buy” ratings, three “Moderate Buys,” six “Holds,” and one “Strong Sell.”

The consensus rating is more bullish than three months ago, when 29 analysts had suggested a “Strong Buy” for the stock.

On Aug. 9, Canaccord Genuity analyst Kingsley Crane reaffirmed a “Buy” rating on Datadog and increased the price target from $145 to $160, reflecting continued confidence in the company’s growth potential.

The mean price target of $161.38 suggests a 25.1% premium to DDOG from current levels. The Street-high target of $200 represents an upside potential of 55.1%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.