Goldman Sachs Stock: Is Wall Street Bullish or Bearish?

/Goldman%20Sachs%20Group%2C%20Inc_%20logo%20and%20cart%20full%20of%20money-by%20Sergi%20Elagin%20via%20Shutterstock.jpg)

Boasting a market cap of $225 billion, The Goldman Sachs Group, Inc. (GS) is a leading global investment banking, securities, and investment management firm headquartered in New York City. Serving corporations, governments, institutions, and individuals worldwide, it operates across four main segments: Investment Banking, Global Markets, Asset & Wealth Management, and Platform Solutions.

The financial powerhouse has posted an impressive performance, significantly outpacing the broader market. GS stock has soared 53.1% over the past 52 weeks and 29.8% on a YTD basis, outpacing the S&P 500 Index’s ($SPX) 20.6% surge over the past year and a 9.6% rise in 2025.

Taking a closer look, GS has also outpaced the iShares U.S. Financials ETF’s (IYF) 27.2% gains over the past year and 11.3% returns in 2025.

On Jul. 16, Goldman Sachs announced its fiscal 2025 second-quarter earnings, and its shares surged marginally. It reported net revenues of $14.58 billion and net earnings of $3.72 billion for the quarter. Its EPS stood at $10.91, while the annualized return on average common shareholders’ equity (ROE) was 12.8%. Additionally, the company raised its quarterly dividend to $4 per share.

Analysts expect GS’ earnings to climb 12.6% year over year to $45.63 per share in the current year, which ends in December. Furthermore, Goldman has a strong history of earnings surprises. It has surpassed the Street’s bottom-line expectations in each of the past four quarters.

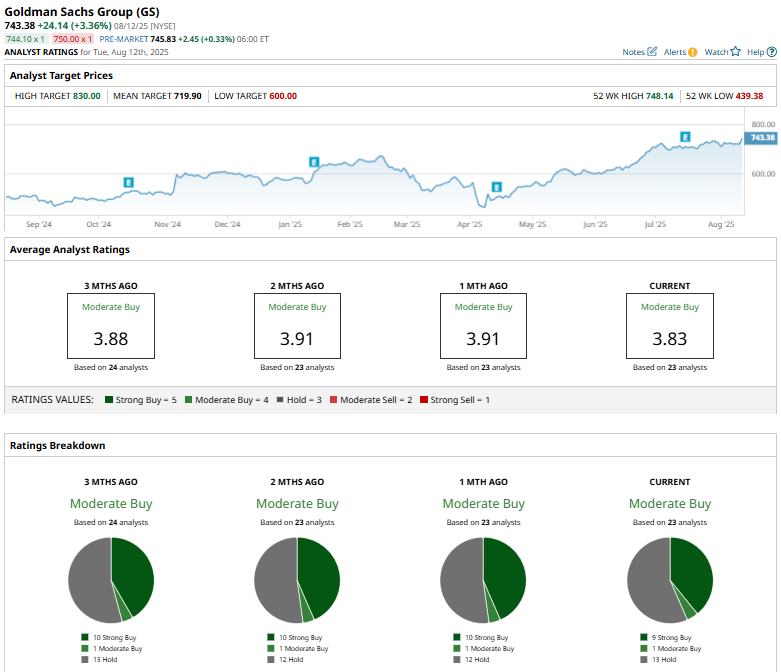

Among the 23 analysts covering the GS stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy,” one “Moderate Buy,” and 13 “Hold” ratings.

This configuration is slightly less bullish than a month ago, when 10 analysts gave “Strong Buy” recommendations for the stock.

On Jul. 21, Citigroup Inc. (C) analyst Keith Horowitz maintained a “Neutral” rating on Goldman Sachs but raised the price target from $550 to $700.

While the stock currently trades above its mean price target of $719.90, the Street-high price target of $830 implies that the stock could rise by up to 11.7% from its current market price.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.