Opendoor Is in the Middle of a Major Transformation. Should You Buy OPEN Stock Here?

Real estate technology stocks have faced their share of challenges in recent years, with high mortgage rates and sluggish housing demand weighing on sales volumes. Yet, some companies are adapting quickly, pivoting their business models to capture new growth opportunities in a shifting market.

One such player is Opendoor Technologies (OPEN), which is undergoing the most significant transformation in its history. Moving away from its legacy single-product approach, the company is now rolling out a distributed platform that offers home sellers multiple options, from instant cash offers to agent-assisted listings and a hybrid “Cash Plus” product. CEO Carrie Wheeler calls this “the most important strategic shift in our history.”

According to management, early results have been promising, with faster offers, higher listing conversions, and broader market reach. And with the shift going from pilot to full-scale rollout in record time, Opendoor believes it’s laying the groundwork for long-term, capital-light growth.

About OPEN Stock

Based in Tempe, Arizona, Opendoor Technologies runs a digital platform for U.S. residential real estate transactions. Founded in 2013, it buys, sells, and lists homes, offering services such as brokerage, title insurance, escrow, and construction. Its products connect sellers directly with buyers or through its marketplace.

Unlike Zillow (Z), which acts as a marketplace and takes a fee as an e-agent, Opendoor purchases homes outright, holds them in inventory, and resells them, a model that carries higher capital intensity and risk, as profits must cover holding and operating costs. It also earns revenue from ancillary services like title insurance and escrow.

Opendoor Technologies stock has seen dramatic swings in 2025. Hit by falling revenue amid a challenging housing market, the real estate tech firm’s shares plunged about 65% in the first half of the year. Then, in a dramatic turnaround, July saw the stock soar 245% thanks to enthusiastic retail buying. It has managed to climb 54% in the year to date.

Despite recent gains, Opendoor’s stock trades at extremely low multiples compared to real estate peers. For example, its price-sales (P/S) ratio is only 0.3x forward sales, versus roughly 4x for the average S&P 500 real estate sector ($SRRE) component.

OPEN Beats Q2 Earnings Estimate

The real estate company recently reported second-quarter results that showed notable improvement from the prior quarter and beat analyst estimates.

Revenue rose 4% year over year to $1.56 billion. It also delivered its first positive adjusted EBITDA in three years, earning $23 million for the period.

Opendoor remained unprofitable on a GAAP basis, posting a net loss of $29 million, an improvement from the $92 million loss a year earlier. Management attributed the narrower loss to tighter cost controls and improved efficiency.

The company sold 4,299 homes in the quarter, up 5% from a year ago, even as acquisitions fell sharply. Contribution profit came in at $69 million, with a margin of 4.4%.

Liquidity remained strong, with $789 million in unrestricted cash at quarter-end. Opendoor also extended debt maturities through a $325 million convertible note offering. While free cash flow remained negative, management said current liquidity supports its ongoing platform transformation.

For the third quarter, Opendoor projected revenue of $800 million to $875 million, about half of Q2’s total, and home purchases of roughly 1,200 versus 1,757 in Q2. It also forecast an adjusted EBITDA loss of $28 million to $21 million.

Analyst Opinions and the Bottom Line on OPEN Stock

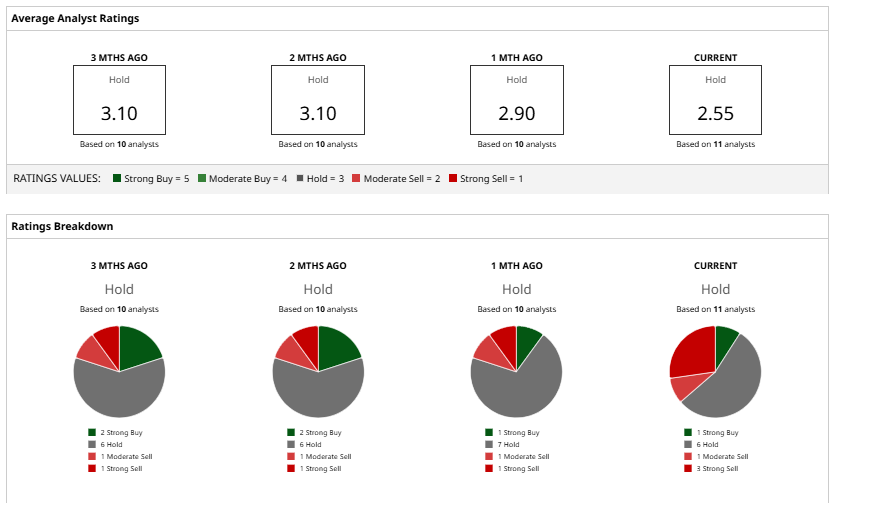

Wall Street analysts currently assign OPEN stock a consensus “Hold” rating, reflecting a balanced but moderately positive outlook. Of the 11 analysts covering the stock, one has issued a “Strong Buy” recommendation, six rate it as a “Hold,” one has a “Moderate Sell,” and one has a “Strong Sell,” indicating a mixed sentiment overall.

Currently, OPEN is trading above its average price target of $1.18, indicating that investor and analyst optimism may already be reflected in the share price.

Opendoor’s move to a distributed agent platform is opening the door to higher-margin opportunities. Still, challenges remain. High mortgage rates, soft demand, potential dilution, and bouts of speculative trading keep the risk profile elevated. Revenue and cash flow have yet to show consistent strength. Long-term, patient investors may find value, while more cautious buyers might choose to stay on the sidelines.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.