Fastenal Stock: Is Wall Street Bullish or Bearish?

/Fastenal%20Co_%20truck%20and%20logo%20on%20building-by%20jetcityimage%20via%20iStock.jpg)

With a market cap of $54.9 billion, Fastenal Company (FAST) is a leading wholesale distributor of industrial and construction supplies across the United States, Canada, Mexico, and internationally. The company offers a wide range of products, including fasteners, tools, safety equipment, and other supplies, serving industries from manufacturing and construction to government and energy.

Shares of the Winona, Minnesota-based company have outperformed the broader market over the past 52 weeks. FAST stock has surged 46.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 20.3%. Moreover, shares of Fastenal are up 33.7% on a YTD basis, compared to SPX’s 9.3% gain.

Focusing more closely, the nuts and bolts maker stock has outpaced the Industrial Select Sector SPDR Fund’s (XLI) 22.8% return over the past 52 weeks.

Shares of Fastenal climbed 4.2% on Jul. 14 after the company reported Q2 2025 EPS of $0.29 and revenue of $2.1 billion, exceeding the forecasts. The beat was driven by higher demand for safety supplies, with non-fastener product sales rising 9.5%, even as the fastener segment lagged amid sluggish industrial production. Additionally, more customers crossed the $10,000-per-month spending threshold, signaling stronger underlying demand.

For the fiscal year ending in December 2025, analysts expect FAST’s EPS to grow 11% year-over-year to $1.11. The company's earnings surprise history is mixed. It met or beat the consensus estimates in three of the last four quarters while missing on another occasion.

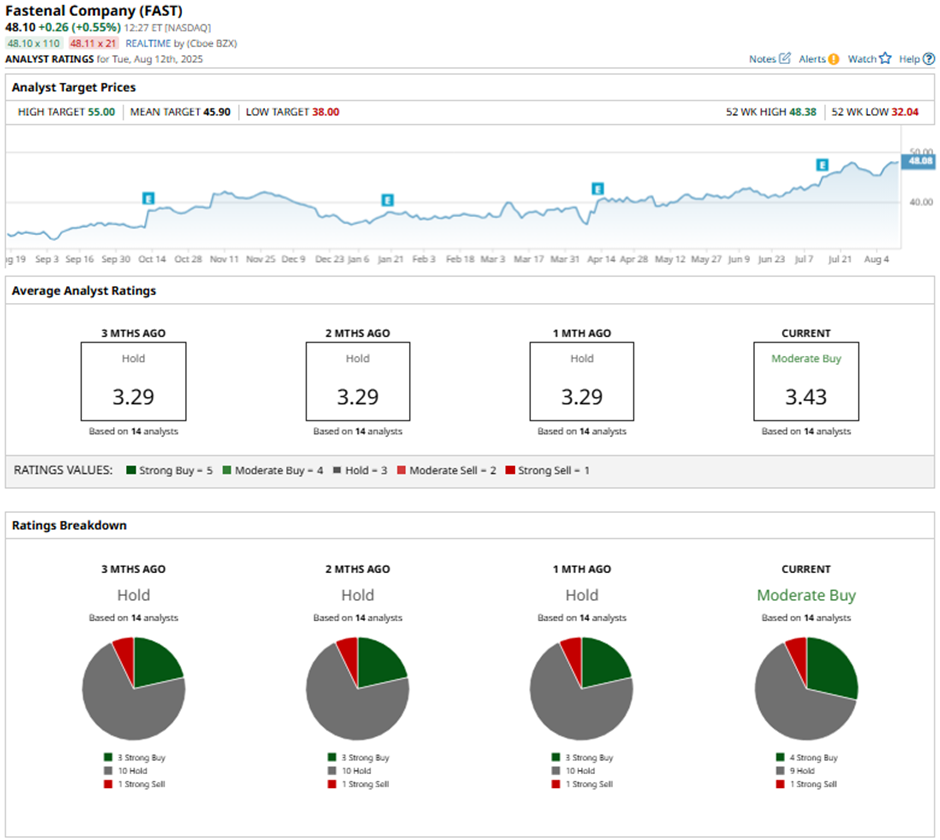

Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on four “Strong Buy” ratings, nine “Holds,” and one “Strong Sell.”

On Jul. 15, Loop Capital raised its price target on Fastenal to $47 while maintaining a “Hold” rating.

As of writing, the stock is trading above the mean price target of $45.90. The Street-high price target of $55 implies a potential upside of 14.3% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.