Advanced Micro Devices Whiffed on Earnings. Should You Buy, Sell, or Hold AMD Stock Here?

/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Advanced Micro Devices (AMD) stock tumbled more than 6% on Aug. 6 after the chipmaker reported quarterly earnings that missed Wall Street expectations, despite beating on revenue and providing optimistic guidance for the current quarter.

In the June quarter, AMD reported revenue of $7.69 billion and adjusted earnings per share of $0.48, compared to estimates of $7.42 billion and $0.49, respectively. At the midpoint estimate, AMD projects Q3 revenue at $8.7 billion, higher than consensus forecasts of $8.3 billion.

The second-largest GPU maker faced headwinds from U.S. export restrictions that “effectively eliminated” MI308 sales to China, costing the company $800 million in the quarter, according to CEO Lisa Su. However, Su noted “positive signals” ahead, expecting AI revenue to grow year-over-year in the current quarter.

AMD’s data center segment increased revenue by 14% to $3.2 billion, while sales from its Client and Gaming division surged 69% to $3.6 billion, driven by strong demand for desktop CPUs and gaming GPUs.

Is AMD Stock a Good Buy Right Now?

Advanced Micro Devices presents a compelling investment opportunity for long-term investors willing to weather near-term uncertainty. AMD’s new MI350 series accelerators began volume production ahead of schedule in June, with Su highlighting that seven of the top 10 AI model builders now use Instinct chips.

The MI350 delivers competitive performance against Nvidia’s (NVDA) B200 and GB200 chips while offering up to 40% more tokens per dollar for inference workloads, providing clear total cost of ownership advantages.

The upcoming MI400 series, launching in 2026, promises 50% more memory and bandwidth than competitors. Moreover, AMD’s Helios rack-scale platform could deliver a 10x generational performance increase for advanced AI models, positioning AMD as a credible alternative to Nvidia's dominance.

AMD continues to gain market share in traditional server CPUs, achieving 33 consecutive quarters of year-over-year gains. It benefits from the growing demand for general-purpose computing infrastructure that supports AI workloads, as each GPU-generated token triggers multiple CPU-intensive tasks.

Sovereign AI initiatives present another growth catalyst. AMD's multibillion-dollar collaboration with Saudi Arabia’s HUMAIN project and over 40 active global engagements demonstrate increasing demand for alternatives to concentrated AI infrastructure.

However, investors should consider risks including intense competition from Nvidia. AMD’s gross margins remain under pressure from the AI product mix, though the company expects continued improvement.

Is AMD Stock Undervalued?

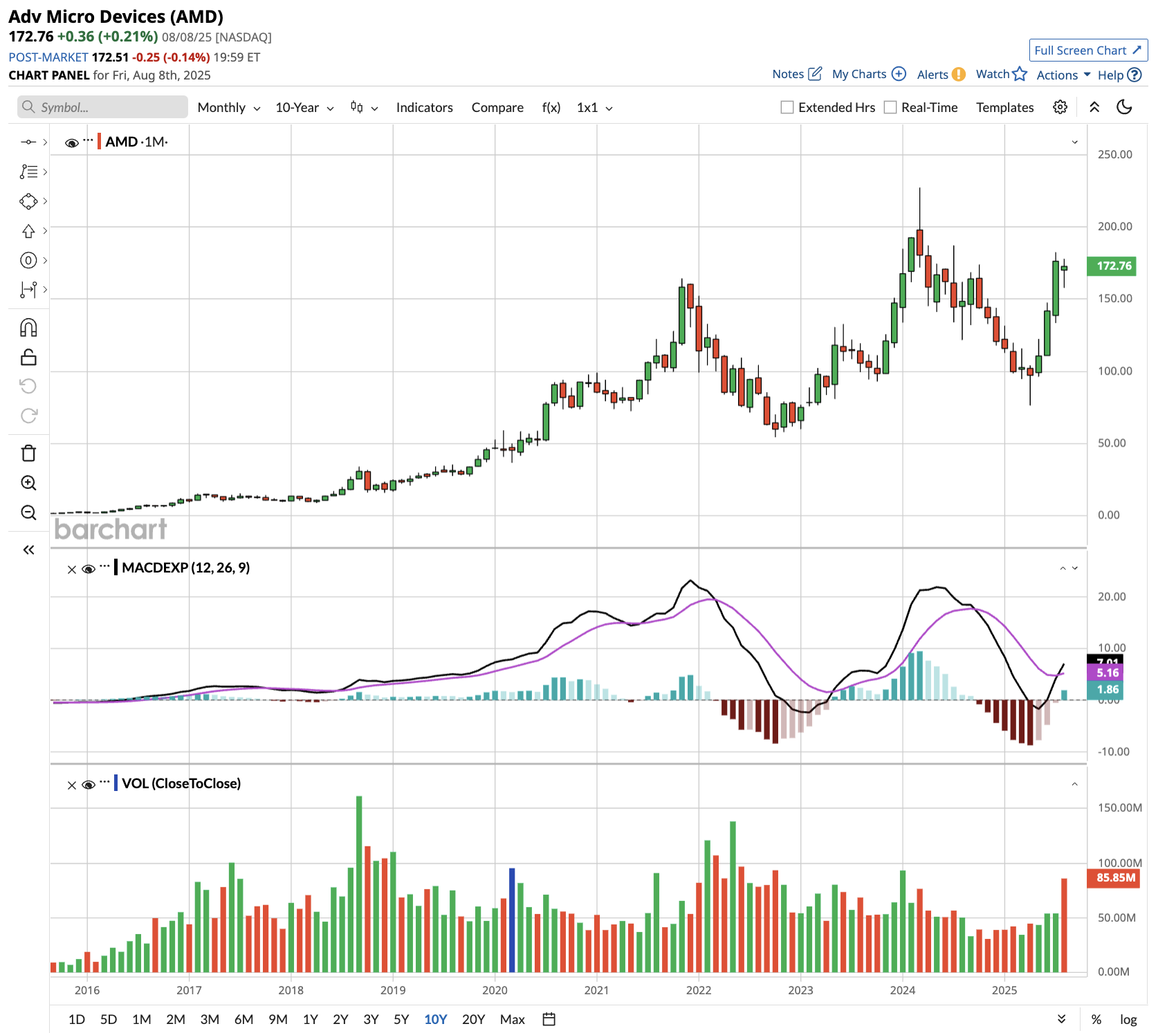

Analysts tracking AMD stock forecast revenue to increase from $25.8 billion in 2024 to $60.40 billion in 2029. In this period, adjusted earnings are forecast to expand from $3.31 per share to $10.56 per share.

Today, AMD stock trades at a forward price-earnings multiple of 34x, which is in line with its five-year historical average. If the tech stock trades at a similar multiple, the stock could be priced around $360 in early 2029, indicating upside potential of over 100% from current levels.

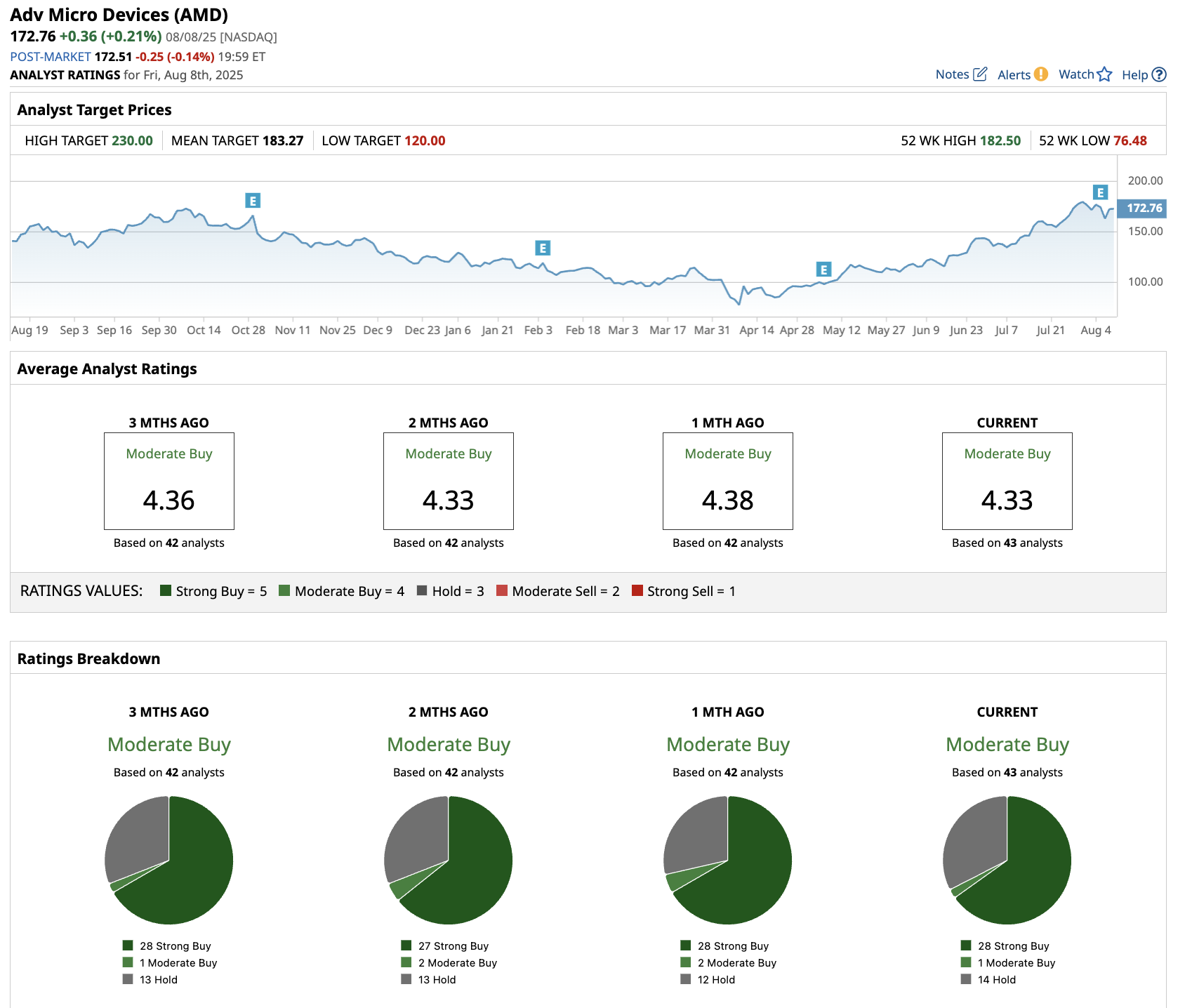

Out of the 43 analysts covering AMD stock, 28 recommend “Strong Buy,” one recommends “Moderate Buy,” and 14 recommend “Hold.” The average AMD stock target price is $183, 6.4% above the current price.

For investors seeking exposure to the AI revolution beyond Nvidia, AMD offers diversified revenue streams, competitive products, and growth potential. The recent pullback in AMD stock may present an attractive entry point for patient investors.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.