SoFi Stock Has Lost Momentum. Should You Buy the Weakness or Stay on the Sidelines?

While SoFi stock (SOFI) is still up 44.5% for the year, it is down 11.4% from its recent highs. The stock had rallied following its Q2 2025 earnings release last month and soared to a multi-year high of $25.11. SoFi has, however, since lost momentum. In this article, we’ll examine whether it makes sense to buy the dip or if investors should wait for a better price level. Let’s begin by looking at SoFi’s Q2 earnings.

SoFi Reported Strong Q2 Earnings

SoFi reported a stellar set of numbers in the second quarter. Its adjusted revenues rose 44% year-over-year to $858.2 million, which easily surpassed the $804.2 million that analysts were expecting. It was the highest percentage growth rate in two years, and that too off a higher base. The adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) rose 81% YoY to $249 million, significantly ahead of the $208.5 million that analysts had modeled.

SoFi Hit Several Records in Q2

The company’s members rose 34% YoY to 11.7 million as it added a record 850,000 members in the quarter. The company hit several records in the quarter, but here are a few notable ones.

- Loan originations rose to a record $8.8 billion: Specifically, personal loan originations rose by 66% YoY while the corresponding increase in student loan and home loan originations was 35% and 92%, respectively. Importantly, the company’s lending business is growing with improving credit metrics, and the Q2 annual charge-off rate in personal loans fell to 2.83% as compared to 3.31% in Q1. Moreover, the on-balance-sheet 90-day delinquency rate for personal loans declined for the fifth consecutive quarter, coming in at 0.42% in Q2.

- Fee-based revenue rose 72% YoY to $377.5 million: The company’s loan platform business generated $2.4 billion in loans on behalf of third parties in Q2. It is a high margin, low risk business for SoFi running at an annualized originations of over $9.5 billion with an annual revenue run rate in excess of half a billion dollars. SoFi’s total fee-based revenue has reached an annualized rate of $1.5 billion, which is quite encouraging.

After the Q2 earnings beat, SoFi raised its annual revenue and profit guidance. I would agree that it was an “exceptional second quarter” for SoFi, as CEO Anthony Noto said in his prepared remarks.

SoFi Stock Forecast

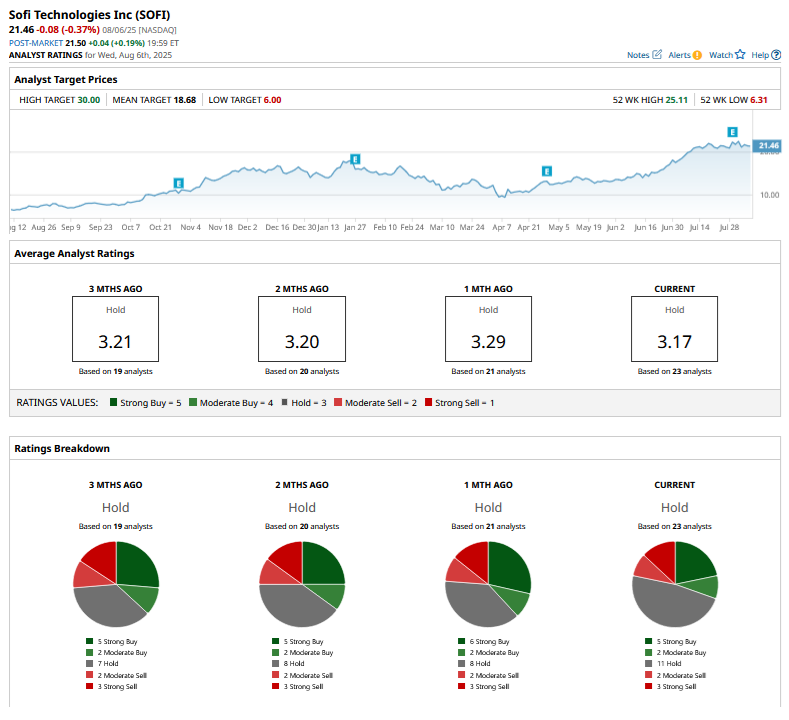

After SoFi’s Q2 earnings release, several brokerages, including Barclays, Morgan Stanley, Needham, and Mizuho, raised their target prices. However, while analysts have gradually raised their target prices, SoFi stock has invariably been trading above what the average sell-side analyst believes it is worth.

The stock has a consensus rating of “Hold” from the 23 analysts as polled by Barchart. Sell-side sentiment toward SoFi hasn’t changed much, and last week Redburn Atlantic initiated coverage on the stock with a “Neutral” rating and $20.50 target price. As I have stated before, the breaking point between sell-side analysts and SoFi is the company’s valuations, which are arguably higher than a traditional bank.

However, the multiples should be seen in the light of its unique business, which is a blend of a bank and a tech company. As Noto said in an interview with CNBC, SoFi is seeing the “growth of a technology company and the profitability of a financial company.”

What Could Drive SoFi’s Growth?

I believe SoFi should command a premium over financial companies, given the mix of its business. Having the banking charter helps SoFi gain access to low-cost member deposits and lowers its reliance on high-cost wholesale borrowing. It also has a tech and financial services business, which is fee-based. Importantly, since the Financial Services and Technology Platform segment is growing at a faster pace than the lending business, its share in SoFi’s revenue mix has been rising and reached 55% in Q2. A growing percentage of fee-based revenues bodes well for SoFi’s valuations.

The expected fall in interest rates could be a tailwind for SoFi’s home loan refinance business, as 3 million of its members have a home loan with another institution, and SoFi could target them for refinancing as interest rates fall further.

SoFi has also been signing up institutional clients, among others, for co-branded debit cards. Between Q1 2025 and Q1 2026, the company expects 10 such clients, which would mean incremental revenues next year. Crypto trading could be yet another growth driver for SoFi next year.

SoFi’s Valuations Are Not Exorbitant

SoFi expected optimism over meeting its 2026 EPS forecast of $0.55 to $0.80 in 2026. At the midpoint of that guidance, we get a 2026 price-earnings (P/E) multiple of 31.8x. The multiple would fall to 26.8x if SoFi were to hit the top end of its guidance.

Those who have been following SoFi for a while will agree that the company ends up beating its guidance quite often, and I don’t have a reason to believe that 2026 will be any different. While SoFi’s valuations don’t appear mouthwatering here, they are not exorbitant eitheṛ

Overall, given the kind of growth engine SoFi has been despite the higher base, I am comfortable holding the shares at these levels even as they might have hit a short-term peak. As for adding more, I would like to wait a bit.

On the date of publication, Mohit Oberoi had a position in: SOFI . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.