Union Pacific Is Buying Norfolk Southern in a Major Railway Deal. Should You Buy the Dividend Stock Here?

/Union%20Pacific%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Railroad giant Union Pacific (UNP) has bid to acquire Norfolk Southern (NSC) in a deal worth $85 billion. The proposed merger, if approved, would create the first U.S. transcontinental railroad, combining Union Pacific’s network with Norfolk Southern’s network. The railroad would encompass more than 50,000 miles, spanning 43 states and connecting to major ports on both the East Coast and West Coast.

On the other hand, this mega-merger is likely to face some scrutiny. Investors have also been skeptical about the move, with investor rights law firm Halper Sadeh LLC already investigating the company regarding this acquisition.

About Union Pacific Stock

Founded in 1862 and headquartered in Omaha, Nebraska, Union Pacific is one of the largest freight rail network operators in the United States. Union Pacific operates more than 32,000 miles of track across 23 states. As a key player in the North American logistics market, the company transports a wide range of goods, including agricultural products and industrial equipment. Currently, Union Pacific has a market capitalization of $131 billion.

UNP stock has been beaten down for quite some time. Over the past 52 weeks, the stock has declined by 5%. For comparison, the broader S&P 500 Index ($SPX) has gained 21% over the same period. So far this year, UNP stock is down by about 2%. Currently, UNP is trading only 9% higher than its 52-week low. Moreover, news of the merger has not been well received by investors, as UNP has declined slightly over the past five days.

On the other hand, this selloff has culminated in an attractive valuation. Union Pacific’s price-to-earnings ratio stands at 19 times, which is lower than the industry average.

On July 16, the company announced a 3% increase in its quarterly dividend rate to $1.38 per share, payable to shareholders on Sept. 30. Its forward annual dividend of $5.52 per share yields an attractive 2.4% on prevailing prices. The company has a record of paying dividends for 126 years, and this raise marks its 19th consecutive year of an annual dividend hike.

Union Pacific’s Q2 Results Topped Estimates

On July 24, Union Pacific reported sound growth in its second-quarter financial results. The company’s total operating revenues increased 2% from the prior-year period to $6.15 billion. At the center of this growth was higher volume and solid gains in core pricing. However, growth was hindered by factors such as reduced fuel surcharges and the business mix. The topline figure was also higher than the $6.11 billion that Wall Street analysts were expecting.

Union Pacific’s freight revenue increased 4% year-over-year (YOY) to $5.84 billion. The company’s adjusted operating ratio was 58.1%. Adjusted EPS stood at $3.03, representing an 11.8% annual increase and surpassing Wall Street analysts’ consensus estimate of $2.89.

For the current fiscal year, Union Pacific expects pricing dollars to be accretive to its operating ratio. The company’s EPS growth is aligned with its long-term target of achieving a three-year compound annual growth rate (CAGR) of high single to low double digits. Union Pacific is also adhering to its long-term capital allocation strategy, with a capital plan of $3.4 billion and share repurchases of $4 billion to $4.5 billion.

Wall Street analysts are still optimistic about Union Pacific’s future earnings. They expect the company’s EPS to increase by 7.6% YOY to $2.96 for the third quarter of 2025. For the current fiscal year, EPS is projected to surge 5.2% annually to $11.67, followed by 9.9% growth to $12.83 in the next fiscal year.

What Do Analysts Think About Union Pacific Stock?

Wall Street analysts are reasonably optimistic about this railroad giant. Following the news release of the mega-merger, analysts at RBC Capital raised their price target from $257 to $276 while maintaining an “Outperform” rating. RBC Capital analysts are optimistic about the creation of a “Trans-Continental powerhouse” that provides significant operating advantages.

On the other hand, analysts at Susquehanna lowered their price target on UNP stock from $260 to $257. However, the financial firm continues to maintain a “Positive” rating on the stock. This most likely means that Susquehanna is taking a cautiously optimistic stance on the company’s merger prospects.

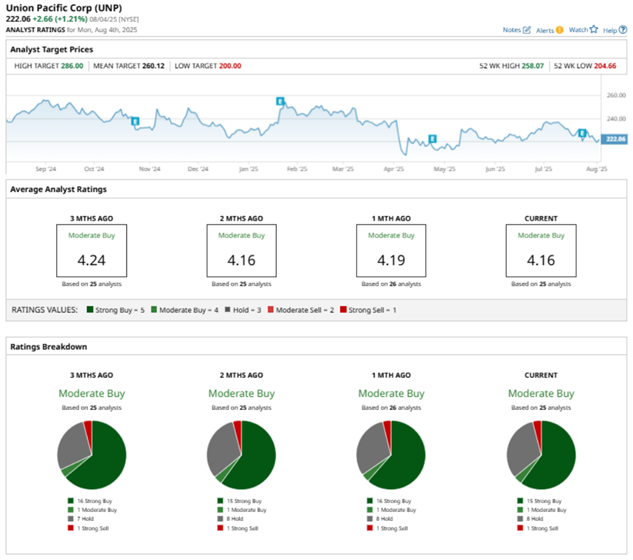

Union Pacific remains a reliable name on Wall Street, with analysts giving it a consensus “Moderate Buy” rating overall. Of the 25 analysts rating the stock, a majority of 15 analysts rate it a “Strong Buy,” one analyst suggests a “Moderate Buy,” eight analysts play it safe with a “Hold” rating, and one analyst gives the stock a “Strong Sell” rating. The consensus price target of $260.12 represents 17% potential upside from current levels. The Street-high price target of $286 represents 28% potential upside from here.

Bottom Line

While the merger is likely to face regulatory scrutiny, if approved, it is expected to be highly accretive to Union Pacific’s operations. While a cautious stance might be prudent, investors may find other aspects of the company exciting, such as its growing dividend. Therefore, it might be sound to consider investing in Union Pacific now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.