Options Traders Expected Palantir Stock's Tamest Earnings Reaction in a Year. Did They Get It Right?

The latest quarterly earnings report is out from Palantir (PLTR), and the stock is moving higher in the initial after-hours reaction. It’s too soon to call this the “Palantir earnings reaction,” as we won’t get that return in the books until Tuesday’s session - but until then, it’s interesting to note that PLTR options traders were pricing in the stock’s tamest earnings reaction in a year.

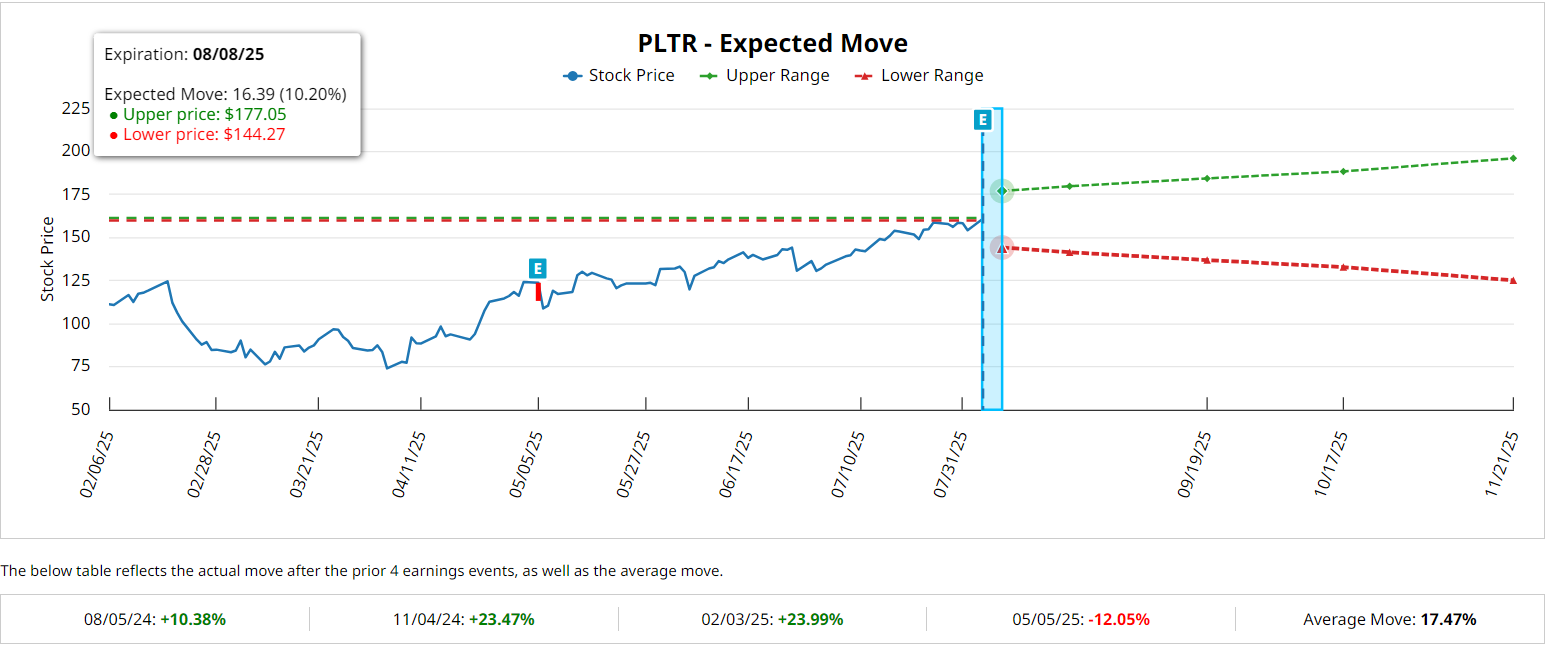

Specifically, the weekly Aug. 8 options series for Palantir stock reflects an expected 10.20% move in either direction after tonight’s earnings, which would be the smallest post-earnings price swing for PLTR in a year, by a very narrow margin.

Palantir’s Q2 Report Crushes Estimates

As for the actual report, Palantir Technologies hit a major milestone in Q2 2025, delivering its first-ever billion-dollar quarter with revenue reaching $1.004 billion. That’s a remarkable 48% year-over-year growth, and it surpassed analysts’ expectations of $939 million. The company's performance was particularly strong in the U.S. market, where revenue surged by 68% to $733 million, with U.S. commercial revenue showing exceptional growth of 93% to reach $306 million.

The government sector continues to be a substantial revenue driver, with revenue increasing by 53% to $426 million, bolstered by significant contract wins - including a landmark $10 billion U.S. Army framework agreement. Palantir’s success here can be attributed to increasing demand for its artificial intelligence (AI) capabilities and expanding presence in defense technology, with strong momentum across both commercial and government segments.

Along with this exceptional Q2 performance, Palantir raised its full-year 2025 revenue guidance to $4.14-4.15 billion, up from previous estimates of $3.89-3.90 billion. Management is guiding for 83% revenue growth in the all-important U.S. commercial segment to over $1.3 billion for the full year.

For Q3, the company projects revenue between $1.083-1.087 billion, representing the highest sequential quarterly revenue growth in company history and a 50% annual increase.

Analysts Are Still Waiting on a PLTR Stock Pullback

PLTR stock is up about 549% over the past 52 weeks, and is the best-performing stock in the S&P 500 Index ($SPX) in 2025. However, Palantir is rated a “Hold” by analysts, largely due to the same valuation concerns that have dogged the stock throughout this multi-bagger rally.

Currently, PLTR is cooling down after an initial post-market surge above $172, and has pared its after-hours gains to a very modest 3.85% at last check. Notably, the gamma-heavy $165 strike could be a key pivot point to watch as the earnings reaction plays out on Tuesday.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Elizabeth H. Volk did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.